Mobile payment risks down, confusion up

There are always, always, always reports of customer data being stolen from various retailers. Supervalu, a Midwest supermarket chain, was hit by hackers last summer. Home Depot investigated a potential security breach in September. Staples looked into a similar problem in October. Target was targeted over the holidays.

Yet, techies still hold out hope that consumers will wholeheartedly embrace mobile payment technology.

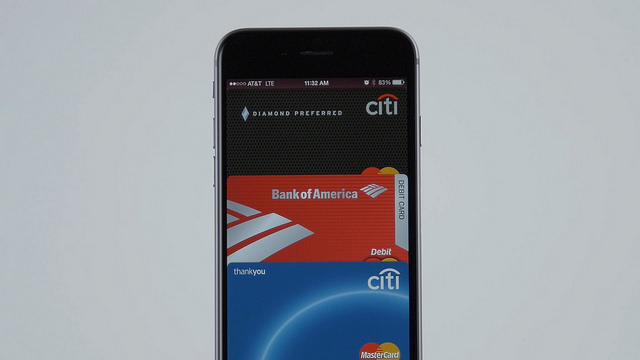

Mobile payment technology has fewer security risks. From MasterCard News.

Wired recently reported on the latest development meant to enhance security: host card emulation, or HCE. And what is that, you may wonder? As the Wired article’s author puts it, “HCE creates an exact representation of the [EMV, or EuroPay, Mastercard, Visa] using only software. The full payment card data no longer needs to reside on a physical chip, which eliminates the need for an SE. This ends the battle for ownership of the previously critical Secure Element, lowering barriers to market entry for new players.”

And in case that’s not clear, the EMV includes a secure microchip for transmitting data. An SE, or Secure Element, is a specialist security chip in your phone.

Now, this HCE business doesn’t completely solve security problems, according to Wired, which further explains that moving data from a chip to the cloud requires an internet connection. Since that can be a problem while shopping, limited-use virtual cards could be stored for use on your phone instead. Unfortunately, the data on those cards is vulnerable to hackers, so additional security features are needed. Authentication methods, for example.

So wait a minute—when data is on software rather than a chip, it still needs to be transferred to the cloud? Why would finding an Internet connection be difficult while shopping? And isn’t payment information typically encrypted anyway, whatever that means?

This may be a wildly old-school concept, but paper money and coins are still a viable solution to the problem of how to pay for purchases, at least when customers are physically in the store. Sure, cash can be stolen. But better to lose a few hundred bucks than your financial identity.

Transactions involving bills and coins have some distinct advantages over mobile technology that shouldn’t be so easily dismissed. Consumers take note. When you pay in cash, you:

- have a clear understanding of how funds are changing hands, no degrees in technological studies required.

- are less likely to create personal debt.

- are more likely to shop locally, enhancing the economy where you live.

- avoid any need to provide personal data at the cash register.

Clearly someone’s financial gain is at stake in the quest to secure widespread adoption of mobile payment technology, despite the risks it currently poses. But until this technology is proven reliable, it doesn’t have to be your money. And it doesn’t have to be your risk.